If you’re not sure why money management is such a big deal, then your money is probably managing you. There’s much more to financial security than just spending less than you make. If you can see past the numbers, you’ll give your money greater respect and do a better job of managing your personal finances. Think about it. Money buys you freedom. You can live wherever you want or travel whenever you like. Money empowers you to pursue your dreams. Financial security ensures that you can eat when you’re hungry and get treatment when you’re sick. It provides a better quality of life now and sets you up for independence in old age.

Most people don’t spend enough time thinking about money until they realize that they are quickly approaching retirement age and need to implement a plan. With the right blueprint, you can avoid coming up short when it matters most.

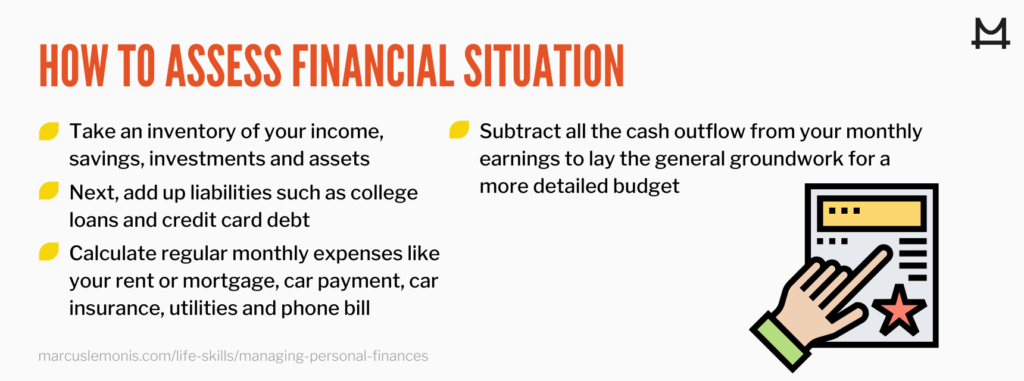

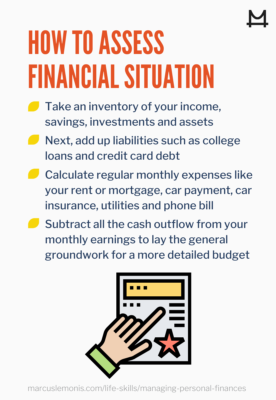

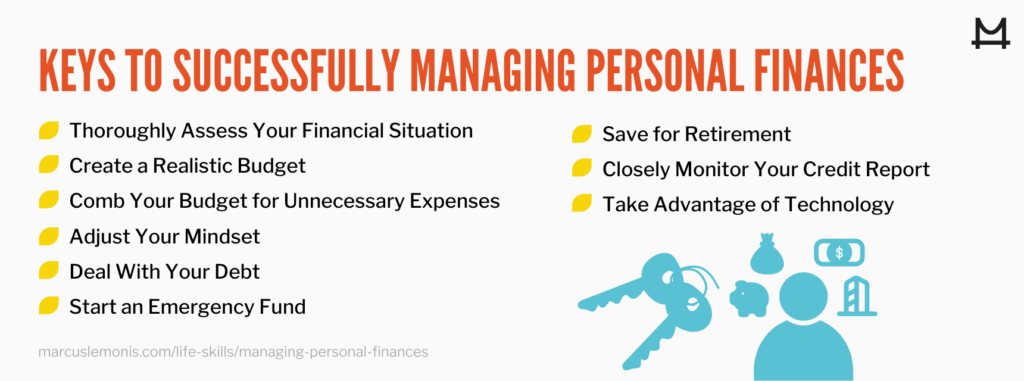

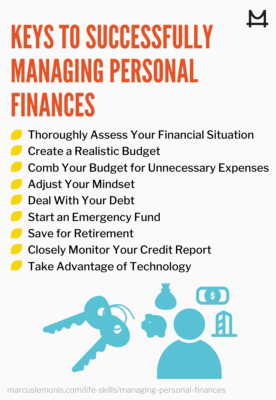

Thoroughly Assess Your Financial Situation

When thinking about a retirement plan, people often dive right in and hastily scratch out a budget. Their intentions are admirable, but they’re overlooking this crucial first step.

Take time to look at the big picture. You must know how much you have to work with before you can budget, save, pay down debt or set financial goals. Whether it’s business or personal, as Marcus says, “The numbers don’t lie.”

- Take an inventory of your income, savings, investments and assets.

- Next, add up liabilities such as college loans and credit card debt.

- Calculate regular monthly expenses like your rent or mortgage, car payment, car insurance, utilities and phone bill.

- Subtract all the cash outflow from your monthly earnings to lay the general groundwork for a more detailed budget.

If you’ve struggled to manage your personal finances for a while, you’ll be tempted to skip this exercise. Don’t. You can’t improve your financial situation if you don’t know what it is. Who knows? Maybe you’ll be pleasantly surprised. Your financial goals might be more achievable than you thought. If you haven’t set any goals, start doing so today. It’s fine if you have to start small. Most people do. Just be sure to put your goals in writing with the current date so that you can measure progress.

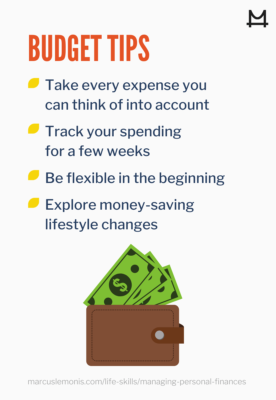

Create a Realistic Budget

Budgeting is simply deciding how much to save and how much to spend. There are all kinds of models and templates on the internet. In the 50/30/20 plan, for example, after-tax income is allocated to one of three categories: 50 percent for needs, 30 percent for wants and 20 percent for savings. Whichever model you choose, take every expense you can think of into account. This will be easier if you track your spending for a few weeks using online banking and credit card tools. Not only will tracking expose wastefulness, such as umpteen streaming services that you never get around to using, but you’ll be reminded of key items like haircuts, Uber rides, dry cleaning, charitable donations and other things that belong somewhere in your budget. Make note of seasonal or annual expenses, like vehicle registration renewal, pet checkups and holiday gift giving, so that you can prepare.

Be flexible in the beginning. If you’re paying down debt, you might not be able to save as much as you’d like. You might realize that fresh flowers belong in “wants” rather than “needs.” That’s OK. You have to start somewhere. Creating a flawed budget is better than not creating one at all. You can always tweak it if your pantry is empty and all your money is squirreled away in savings.

Comb Your Budget for Unnecessary Expenses

Your budget will expose careless spending, but it will also highlight opportunities to save. Consider stretching the time between pedicures. Cancel club memberships and subscription services you no longer want before they automatically renew. Organize a carpool. Get rid of cable.

Explore money-saving lifestyle changes too. Consider moving to a smaller place or sharing with a roommate for a while. Look for opportunities to save money that benefit your health at the same time. Eat more grains and vegetables. Limit happy hours with friends, and quit the tanning salon. For the love of Pete, stop smoking. Healthy changes will fatten your wallet now and reduce your medical costs down the road.

Adjust Your Mindset

People associate good spending habits with discipline, and that certainly plays a role. However, changing your whole mindset about money will make it easier to resist impulse buying and stick to the budget. Don’t just think of money in terms of your bank balance or what you owe to Visa. Again, see past the numbers. Think of tangible things that every dollar amount represents. Twenty dollars might represent two lunches out or a pack of athletic socks. A hundred dollars might represent a new pair of jeans, a facial or a couple of oil changes. If you dream of traveling, think of $1,000 as airfare or a hotel stay.

That way, if you’re saving up for socks, a morning at the spa or a well-deserved vacation, you’ll be less likely to buy things that aren’t important to you. If you continue to track spending, purchases that don’t align with your priorities and goals will stick out like a sore thumb.

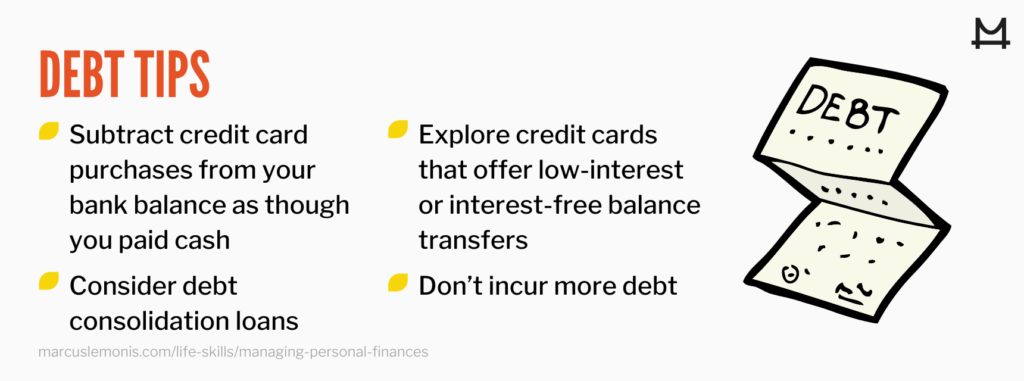

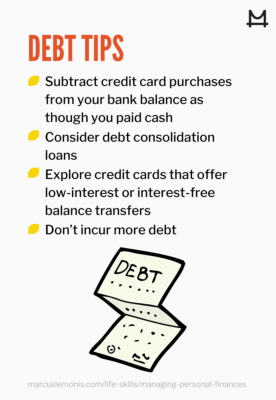

Deal With Your Debt

Whatever sacrifices you make to avoid debt or climb your way out of it will be worth it. Debt severely limits your ability to buy what you need when you need it. It keeps you from being generous, rewarding yourself, saving for the future and fulfilling your dreams.

Whatever accounting method you use, subtract credit card purchases from your bank balance as though you paid cash. Your bank balance will appear smaller than it really is, but you’ll always have the money to pay your credit card balance in full. If you’re in debt but still have a fairly decent credit score, you may be able to consolidate certain loans and credit card accounts. Debt consolidation loans typically offer lower interest. Just make sure that the lender you consolidate with is legit. You should also explore credit cards that offer low-interest or interest-free balance transfers for a fixed period of time. It might be a year or even 18 months. If your current card is charging you anywhere from a 15 to 25 percent annual percentage rate, you could save a fortune in interest. Transfer only an amount that you’re confident you can pay off before the offer expires, and don’t incur more debt.

Start an Emergency Fund

Every day, people go into the red because they’ve set nothing aside for emergencies. Start socking away as much as possible each month. Experts suggest saving enough to cover three to six months’ worth of expenses. Mind you, Black Friday is not an emergency. A Brazilian blowout is not an emergency. Examples of an emergency include job loss, a blown transmission and rabies treatment.

Save for Retirement

If you’re counting on Social Security to cover you in retirement, you’ll most likely be disappointed. It will replace around 40 percent of your income at most. As soon as possible, enroll in your workplace 401(k) or other retirement savings plan. There are tax benefits, and your employer might match a portion of your contributions. If you don’t have access to a plan like that, talk to a banker about other options like an IRA. Try to save at least 10 to 15 percent of your income.

The importance of building a nest egg can’t be overstated. The golden years sneak up quicker than you think. It’s never too early or too late to start saving, but saving is far more burdensome the older you get. Consider this scenario: A 25-year-old woman has a retirement account with an 8 percent rate of return. She manages to save a little under $500 a month. By the time she turns 65, she’ll have around $1.7 million to retire on. If the same woman waited until she was 30 to start saving, she’d have to save closer to $750 a month to end up with the same amount.

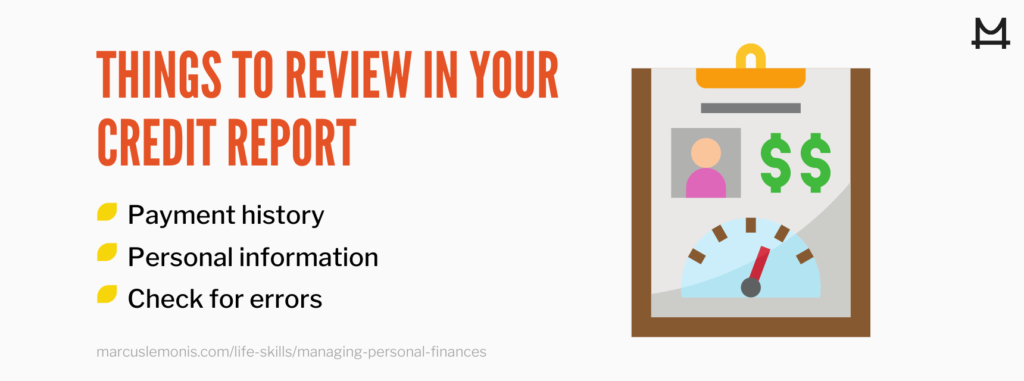

Closely Monitor Your Credit Report

Traditionally, people were entitled to a free credit report once every 12 months. For now, at least, the big three credit reporting bureaus — TransUnion, Experian and Equifax — are offering free access once a week. Each bureau has slightly different methods of reporting, so check out all three. The reports show all your credit accounts, credit activity and payments. They assign different weights to various things that impact your credit score. Payment history is one of the most critical categories. At Experian, for example, it accounts for a whopping 35 percent of your credit score. Late payments can hang around on your report for up to seven years. So pay your bills on time.

Carefully review your personal information; any changes that you didn’t make could indicate identity theft and should be reported right away. Check for errors, accounts you don’t recognize, and collection actions that are unfamiliar to you. Disputing mistakes is easier than ever. Just follow the prompts on the website.

Take Advantage of Technology

There are dozens of apps to help you manage your money, create a budget, track spending in real time, and make investments. Many are free. Some of the most popular apps are Mint, YNAB, EveryDollar, Clarity Money and Personal Capital. They’re all available on iOS and Android devices.

Online, you can access budget templates, various financial calculators, savings plans, e-books, webinars and blogs. Try the America Saves, Kiplinger, LearnVest and NerdWallet websites. If you like podcasts, Forbes recommends So Money, ChooseFI, Afford Anything, Stacking Benjamins and others.

To get the most bang for your hard-earned buck, actively manage your personal finances. Put your money to work for you. Forming better habits now will dramatically improve your financial outlook for 2021 and beyond.

This article is informational only and subject to errors or omissions. As with any legal or regulatory advice, please consult your legal counsel or tax advisor to make sure you are in compliance with all and any federal, state, city or county rules and regulations. More

- What steps can you add to your current money management routine?

- How often do you check your credit score?