When you were a little kid, you probably got excited whenever you got a piece of mail. It usually meant you were getting invited to a birthday party. But somewhere along the line, your relationship with the mail changes, especially if you have debt. A lot of people feel overwhelmed by how much money they owe, and something as simple as getting the mail can be a little bit stressful. Here’s a really encouraging piece of news, though: debt can actually be a good thing. Especially if you’re smart about it. This article takes a closer look at how to manage debt, so you can make sure it’s lifting you up instead of weighing you down. Because when it comes to personal finance, knowing how to manage debt is one of the most important pieces of Marcus Lemonis’ “Know your numbers” philosophy.

Is Debt Good or Bad?

As you learn how to manage debt, just know that it can actually be your friend. Debt can suddenly make a laptop, phone, or car affordable. It can also help you through an emergency situation, like when you need to pay for an urgent dental procedure. You can even turn debt into free money through rewards programs like cash back or discounted airfare. If you’re really responsible about paying back your creditors, your credit score goes up, and you can eventually buy a home. That’s a huge deal because it allows you to build equity, and in turn, wealth. But if you don’t know how to manage debt, it can hurt your credit score, lead to higher interest rates, and cost way more money to pay off your debt over time. It can also make it tougher to get loans down the road. The loans you do get could be more expensive. And you might have a hard time buying a home and building equity.

But here’s the biggest thing to take with you into this article: if you’re not sure how to manage debt, that’s okay. Every challenge in life is manageable, no matter how large. So, whether your financial situation is under construction, or you’re about to open your first line of credit, it’s important to get a better feel for it. Because like Marcus always says, “We have to know how much money we have, what we’re spending it on, and keep track of our expenses at all times.”

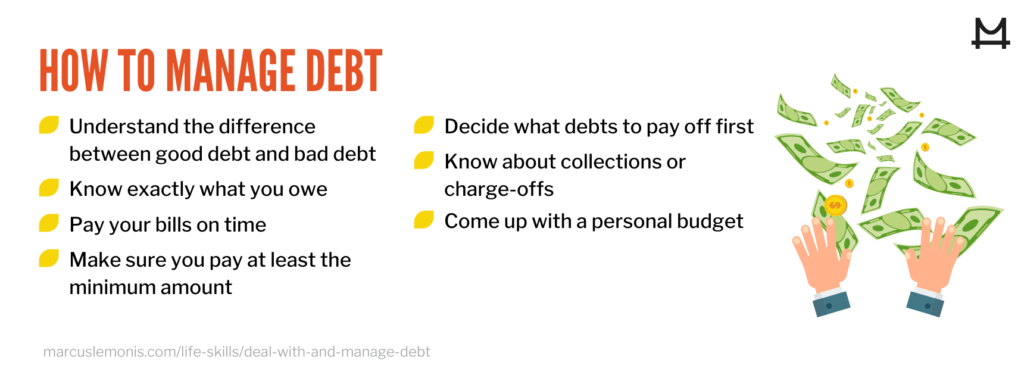

Know Exactly What You Owe

Whether it’s through a spreadsheet or a personal finance app, make a master list of everything you owe. That list should get really specific about who you owe the money to, the interest rate, and of course, when the payments are due. Don’t just track your debt either. Track every single financial obligation. While your electric bill isn’t typically financed by taking on debt, it’s still a big part of understanding your financial situation, creating a personal budget, and of course, meeting your financial responsibilities. A bill-pay grid also helps you stay on top of everything in a proactive way. If you’re waiting for an email notification from one of your creditors, what if that goes to your spam filter? What if they usually send you a hard copy of the bill, but then you move apartments? Keeping your own log helps you create an airtight system for grabbing your debt by the horns.

Pay Your Bills on Time

When you’re learning how to manage debt, it’s not just about how much you owe. It’s also about when you owe it. If you’re late on bills, that can result in penalties, fees, and in some cases, can hurt your credit. So, set a calendar reminder for whenever your bills are due. Google Calendar and iCal both have great custom reminder features that really help you stay on top of things in your own way. But however you do it, make sure you have a system. “Going on feel” might work for a few months in a row, but when life gets crazy, you’ll be glad you have an automated system for reminding you about all of this.

Autopay is a really helpful feature too. If you’ll reliably have enough money in your checking account, automating your payments helps keep them running like clockwork.

Make at Least the Minimum Payment

From time to time, everyone finds themselves in a pinch financially. That’s okay. It happens. But make sure you still make your minimum payments. Otherwise, you’re in for late fees, your interest rate might increase, and you could even hurt your credit score. But you really want to try and pay more than the minimum whenever possible. That helps you pay down your debt over a shorter period of time, decreases your total interest, and improves something called your credit utilization ratio. That’s a ratio that measures how much of your credit line you’re actually using. If your credit is always maxed out, your ratio is really high, which gives the impression of financial strain and hurts your credit score. That’s why a lot of experts recommend using a relatively low percentage of your available credit line. This gives the impression that your finances are under control, helps your credit score, and earns you a better interest rate on your loans.

Decide Which Debts to Pay off First

Everyone’s financial situation is different, but when you’re deciding which debts to pay off first, be aware of two common strategies. The first is called “The Debt Snowball.” This was popularized by Dave Ramsey, an American real estate investor and businessman. With this approach, you pay off the smallest debt first, then the second smallest debt, and so forth. He believes this gives you a psychological advantage because you see victories early on in the process. With this method, you definitely still want to make the minimum payments on your other debts.

But a lot of people still think there’s value in creating momentum with a few early wins. The other popular method is called “The Debt Avalanche” in which you pay down the high-interest debts first. Investopedia, a prominent finance publication, says this is the most mathematically sound decision because you shorten the length of your high-interest debts, which decreases the amount you pay in interest over time. But whichever way you go, congratulations. You’re already taking financial responsibility by learning how to manage debt.

Collections and Charge-Offs

A huge part of managing debt is knowing what happens when you can’t pay it off. If you haven’t been making your payments, the place you owe money to will start by following up. They’ll do this for quite a while, but eventually, they’ll “charge off” the debt. This means they give up on trying to collect the debt themselves and refer it to a collections agency. Credit Karma notes that this typically happens when you’re about 120 – 180 days late on a payment.

From there, the collections agency will follow up with you on behalf of your creditor, remind you about the debt, and try to collect your payment. Charge-offs definitely hurt your credit, and according to CreditCards.com, stay on your credit report for seven years. But it’s also important to know that charge-offs aren’t forgiven and you still owe the money. So, don’t give up on these debts. Rebuilding your credit is definitely a process, but people do it all the time. You can, too.

Personal Budgeting

Another great tool for managing debt is coming up with a personal budget. Again, the specifics of your budget will flow from the specifics of your financial situation. There’s no universal rule. But here are a few things to keep in mind as you start to get financially organized.

- Fidelity, a global financial services company, has something they call a “50/15/5 Rule.” That rule suggests putting 50% of your take-home pay towards essential expenses, 15% towards retirement, and 5% towards short-term savings.

That leaves about 30% of your take-home pay up to you, whether that’s buying a plane ticket to see a friend, giving a wedding gift, or paying down debt.

- A lot of financial planners talk about slowly building up an emergency fund that could float you for at least six months. So, if you get hurt or lose your job, you can tap that emergency fund instead of relying on credit and running up your balance.

- Another metric to keep in mind is Wells Fargo’s debt-to-income ratio, which they advise you to keep under 35%. They also mention the lower the better. A low ratio makes your loan application more attractive and easier to approve. It could also get you a better rate.

But you could argue the number one rule with personal budgeting is Marcus’ “Know your numbers.” Everyone’s situation is unique. So, make sure you work towards a budget that passes your own common-sense test. Further, every time you think about taking on more debt, ask yourself if you really need to. A lot of times, the answer will be “yes.” But do you really need to finance that second water bed at a 20% rate? Maybe. But maybe not. A little restraint goes a long way in the debt department. If you have trouble formulating a budget or clarifying your financial situation, talk to a professional. They’ll probably try to talk you out of that water bed.

Help Is Always Available

If you think you might be in over your head, or it feels like your debt is getting away from you, you’re not alone. In fact, you’re so not alone that there are entire professions dedicated to helping people in your exact position. Credit Counselors can assess your financial situation and help with budgeting, educational workshops, and debt management plans. These debt management plans can vary, but oftentimes, they take a few different lines of credit and consolidate them into a single payment. Their goal is typically to lower your interest rate, come up with a payment plan to settle your debts, and just help the entire process feel way more manageable.

You can also explore something called a debt settlement program. This is when you approach your creditors through a company that helps negotiate a settlement. The settlement will typically be less than what you owe and more realistic to pay back. But if you go this route, make sure you thoroughly research the specifics of the program. For example, sometimes it’s structured where you deposit your payments in an agreed-upon account, rather than pay the creditors back directly. But this could mean that your creditors continue to tack on penalties until they actually have the money. You also might run into a few debt settlement scams, so be sure to check into these companies. The Federal Trade Commission gives a few helpful pointers when you’re vetting these opportunities. So, when it comes to debt settlement, read the fine print, then read it again.

You should be proud that you’re learning how to manage debt, but always remember that it’s nothing to be afraid of. The good kind of debt helps you build credit and wealth. Even the bad kind of debt can be managed. If you’ve let your financials slip a little bit, that’s okay. It’s like Marcus always says, “People make mistakes. I know I do. It’s how you resolve it that matters the most.”

- What are some ways that you manage your debt?

- Is there something you learned that you can now implement in your debt management?

DaveRamsey.com. (n.d.). How the debt snowball method works. Retrieved from https://www.daveramsey.com/blog/how-the-debt-snowball-method-works

Eneriz, A. (2020, May 20). Debt avalanche vs. debt snowball: what’s the difference? Retrieved from https://www.investopedia.com/articles/personal-finance/080716/debt-avalanche-vs-debt-snowball-which-best-you.asp

Proctor, C. (2020, September 1). What should I know if I have debts in collection? Retrieved from https://www.creditkarma.com/advice/i/accounts-in-collections#:~:text=When%20you%20have%20a%20debt,to%20a%20debt%20collection%20agency.

Thangavelu, P. (2020, May 18). How to remove a charge-off from your credit report. Retrieved from https://www.creditcards.com/credit-card-news/remove-charge-off-credit-report/

Fidelity.com. (2020, March 3). 50/15/5: a saving and spending rule of thumb. Retrieved from https://www.fidelity.com/viewpoints/personal-finance/spending-and-saving

WellsFargo.com. (n.d.). What is a good debt-to-income ratio? Retrieved from https://www.wellsfargo.com/goals-credit/smarter-credit/credit-101/debt-to-income-ratio/understanding-dti/

Consumer.FTC.gov. (2012, November). Settling credit card debt. Retrieved from https://www.consumer.ftc.gov/articles/0145-settling-credit-card-debt#:~:text=Debt%20settlement%20programs%20typically%20are,the%20full%20amount%20you%20owe.