Do you remember the first time you climbed on a bicycle? You probably fell down a time or two, before finding your balance and riding off with your friends. Starting and running a business is also a balancing act. You need to understand the risks, and make smart decisions in order to reap the rewards of success. As Marcus Lemonis says, “The definition of an entrepreneur to me is the willingness to fail, and it takes a lot of guts and a lot of heart to take that chance.”

As an owner, you face a constantly changing constellation of risks in business. Some are within your control, like avoiding breakdowns in your production process. Then there are the large-scale risks of recessions, pandemics, hurricanes and earthquakes. Other risks fall somewhere in between, like the possibility of losing a major customer if a problem arises.

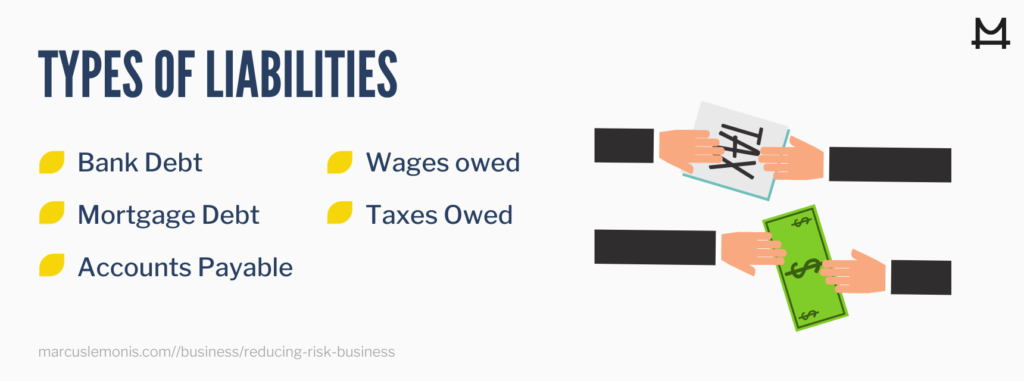

Business owners also need to understand how to manage their liabilities, including bank loans, payroll taxes, and accounts payable. Again, this is often a matter of finding the right balance. Some liabilities can provide you with financial leverage to grow your business, while others carry the risk of financial penalties for noncompliance.

In business, you can’t avoid risks or liabilities. But you can take steps to mitigate their impact and protect yourself against an unexpected surprise or a recurring problem.

What is Risk in Business?

Almost everything you do in business involves some degree of risk. Things can go wrong when meeting a prospective customer, hiring a new employee, launching a new product or investing in a technology platform, just to name a few. But you can’t let a risk in business prevent you from taking action. After all, doing nothing is probably the biggest risk in business!

Here are Some of the Types of Risk in Business You Face Every Day

Economic Risk

A downturn in the local, state, national or global economy could have serious implications for your business. Customers can cut back on their orders or your market could simply dry up. Think about the movie theaters, gyms and restaurants, just to name a few of the businesses that were shut down to reduce the public health risk of COVID-19.

Compliance Risk

You don’t have to be a lawyer to know that you could face steep fines from the IRS if you don’t pay your income tax on time. Other compliance risks include local building and zoning codes, or regulations specific to a particular industry, such as patient confidentiality in healthcare or “know your customer” rules in banking.

Labor Risk

From the time a new employee goes on your payroll to her last day at work (and beyond), you run the risk of a labor-related issue. You need to follow all the employment laws and codes, from overtime to workplace safety to anti-discrimination rules. You also need to train and monitor employees to be sure their actions comply with your business’ policies and procedures.

Materials Risk

You might find that a supplier has delivered the wrong materials, leaving you unable to fulfill customer orders. Other risks include a jump in costs or the disappearance of a vendor, leaving you scrambling to find an alternative supplier.

Security risk

Businesses face both physical and online security risks, from outsiders entering your facility to hackers trying to break into your network. You also need to guard against internal and external frauds, such as “phishing” schemes designed to steal an employee’s identity credentials.

Operational Risk

Many things can go wrong in your business’ daily operations, from a supplier’s mistake to a service truck’s breakdown to key production people coming down with the flu.

Reputational Risk

Your employees may make a mistake, your customers may be unhappy with your performance or a compliance or regulatory issue suddenly makes the headlines. These are some of the ways a hard-won reputation can be damaged, temporarily or permanently.

Competitive Risk

Your competitors might launch a new product or service, or conduct a creative marketing campaign designed to steal your customers. To maintain your position, you need to be able to counter these types of competitive risks in business. For example, Marcus met with the owner of a Los Angeles company specializing in leather handbags. He saw that her product line needed a stronger, more creative approach to compete successfully. Together they reviewed competitors’ styles, pricing and materials to come up with a modified approach. With new designs, high-end packaging and a stronger brand, the business saw sales and profitability take off.

What are Liabilities?

One of the biggest financial risks in business involves liabilities. Companies need to understand the risks of taking on liabilities and plan a balanced approach. Taking on too many liabilities can cripple a business’ ability to perform. For example, global telecommunications company Avaya filed for Chapter 11 bankruptcy in 2017 to reduce its $6.3 billion in debt. After a restructuring, it emerged in a much stronger financial position.

Here are the Key Types of Liabilities That You Need to Manage Effectively:

Bank Debt

Whether you have a one-time loan or an ongoing line of credit, you need to be sure your business generates enough cash to meet those repayment obligations. If problems arise, talk with your banker to see if your debt can be renegotiated.

Mortgage Debt

If you are financing a business property, you need to keep making those mortgage payments. Again, meet with your lender if you need to extend the mortgage or change the terms.

Accounts payable

Some types of businesses purchase large quantities of goods or services from suppliers on a regular basis. As a result, their accounts payable can start mounting up. These liabilities also need to be kept in balance to reduce financial and operational risks.

Wages Owed

At any given time, your business may owe a significant amount of wages or salaries to your employees. Therefore, incoming revenue needs to cover this labor-related liability, before being used for other purposes.

Taxes Owed

You don’t want to get into trouble with the IRS over this liability. So pay your taxes as required on time. End of story!

Starting a Business?

Understanding risks and liabilities is one of the fundamental steps you should take before starting a business. It’s easy to get carried away by a great idea or an opportunity to capture a particular market. After all, “If you don’t have emotion and you don’t have passion, then you shouldn’t be in business,” as Marcus says.

But you have to use your head as well as your heart when launching a new business, expanding to new markets or developing a new product or service. Unless you understand risk in business and take appropriate action, your business might go under before you can begin to enjoy the rewards of success.

Tips to Reduce Risk in Business

When Hurricane Harvey was heading for Houston in 2018, Goodyear took proactive steps to reduce the risks to its local facilities. The Fortune 500 tire manufacturer shifted people to other locations and moved inventory out of the area. During and after the storm, Goodyear stayed in close contact with suppliers and customers, and worked closely with insurers and remediation firms to get its plants back in operation again.

Here are Several Ways You Can Mitigate The Risk in Business and Help Find the Right Balance Moving Forward

Prepare a Solid Plan

Before implementing a growth strategy, take the time to develop a written plan. Identify the risks and determine the liabilities in advance. That’s the best way to avoid costly surprises and keep your business on track.

Keep Good Records

Being able to document your decisions and actions will go a long way to mitigating labor, material and operational risks. Good records are also essential for effective customer relationship management, particularly when handling complaints or other issues.

Establish Quality Standards and Controls

Make sure that your products and services deliver the benefits your customers expect. Otherwise, you run the risk of over promising and under performing.

Limit Your Loans

It can be tempting to borrow a large amount from your bank to pay for a new investment or expansion plan. But remember that your revenue will need to increase as well in order to meet those obligations. Most successful small businesses limit their financial liabilities, including bank loans and mortgage payments.

Purchase Insurance

Buying property, liability and business interruption policies can mitigate many of the risks in business. Talk with your insurance agent or broker about package coverage as that may be less expensive than purchasing multiple policies.

Collect Accounts Receivable in a Timely Manner

Don’t let your customers run up large balances that jeopardize your cash flow. Otherwise, you run the risk of running short of funds when it’s time to pay your employees, your suppliers and your tax liabilities.

Save Your Cash

Maintaining a healthy balance in the bank can help you through times when cash flow is lower than normal, and provide a cushion if unexpected expenses arise.

Balance Risk in Business With the Rewards

Success in business – like riding a bike – involves balancing risk and reward. Too much caution and your business can start wobbling and falter. But going too fast leaves you vulnerable to the many potholes and twists in the road ahead. As Marcus says, “Things are always going to go wrong. People make mistakes. I know I do. It’s how you resolve it that matters most. Listen, be open to criticism, resolve it with speed and empathy, and take responsibility.”

- What are some risks that your business is likely to face?

- What are some of the liabilities you should try to avoid?

Moise, I. & Jarzemsky, M. (2017, January 19). Avaya files for Chapter 11 bankruptcy protection. Retrieved from https://www.wsj.com/articles/avaya-files-for-chapter-11-bankruptcy-protection-1484848150

Morris, G.D.L. (2018, September 14). This risk manager’s meticulous planning ensured his Fortune 500 company weathered Harvey. Retrieved from https://riskandinsurance.com/weathering-harvey/