Why It’s Important to Know Your Numbers

When a lot of small business owners first open their doors, they have one simple goal. They want to keep those cash registers ringing. But a lot of people are surprised to learn that you can bring in a lot of money without actually turning a profit. How does that happen? It happens when you don’t know your numbers. Maybe you’re making decisions based on bad information. Maybe there was a problem that you didn’t catch in time. Or maybe you were so focused on running the place that the numbers fell by the wayside. If any of that sounds familiar, that’s okay. Marcus Lemonis has the answer. He’d tell you it’s essential that you “know your numbers,” so you can pinpoint problems, plan for the future, and find all of those little ways to improve. So, take this quiz to see how well you really know your numbers. Because it’s like Marcus always says, “If you don’t know your numbers, then you don’t know your business.”

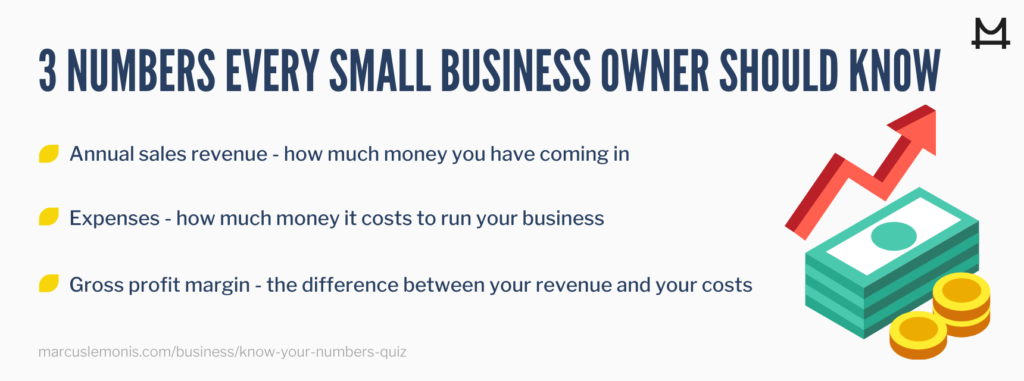

What Are Three Numbers that Marcus Says Every Small Business Owner Should Know?

1. Annual Sales Revenue. That’s how much money you have coming in and it’s a number you absolutely have to know. If you sell a product or multiple products, to get this figure, you simply multiply the number of units you’ve sold by their selling price. But keep in mind, this is NOT your net income, which you’ll read about later.

2. Expenses. How much money does it actually cost to run your business? What’s that “all-in” number? Keep a comprehensive log of everything you’re spending, but also, everything you’re about to spend.

3. Gross Profit Margin. Start with your revenue and subtract all the direct costs associated with making and selling your products and services. That gives you your gross profit. But gross profit margin is usually expressed as a percentage. So, to get that percentage, you just take that gross profit and divide it by your revenue. You’ll take a look at why that percentage is so helpful later on, but for now, just consider it a huge part of “knowing your numbers.”

Should You Base Your Annual Sales Revenue on the Calendar Year?

For most companies and most industries, it makes sense to base your annual sales revenue on the calendar year. But you also want to calculate your revenue based on a “Trailing Twelve Months,” sometimes referred to as “TTM.” When you take a look at the most recent twelve months, you always have this metric at your fingertips instead of having to wait until the end of the calendar year to make use of it. You also chop off some of the old data that you take into account when you’re just doing this according to the calendar. Either way, you really want to make sure that you take a look at both of these 12-month time horizons. They give you a big enough sample size to paint a clear picture of what’s going on, and smooth out seasonal peaks and valleys.

Do You Pay Your Bills with Revenue or Gross Profit?

You can’t use revenue to pay your bills, because there’s already a certain amount of money that’s spoken for. That amount is known as your direct costs. Let’s say you run a car dealership. You can’t sell a bunch of cars without paying for all of that inventory, right? So, if you want to know how much money you have left to cover your bills — like rent and utilities — you look at a metric called Gross Profit.

Investopedia has a really clear way of defining that when they say, “Gross profit is the profit a company makes after deducting the costs associated with making and selling products.” So, calculate that number and you’ll have a clear sense of how much money you have left to cover your bills.

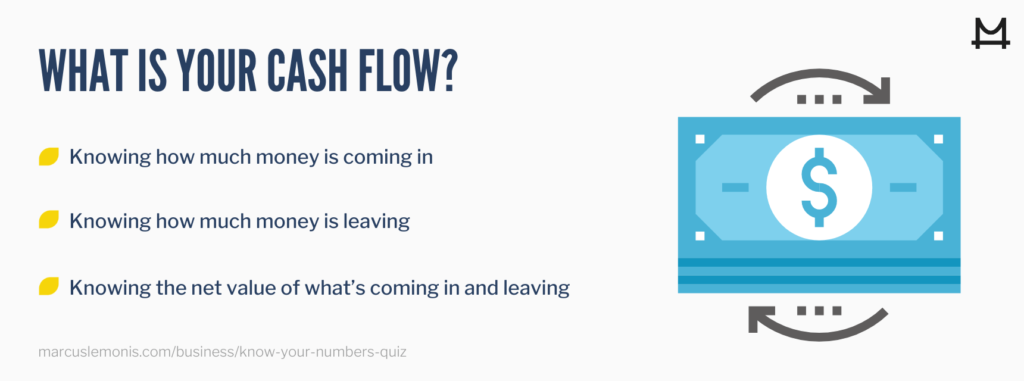

Do You Know What Your Cash Flow Is?

You always want to know how much cash is coming in, how much is leaving, and where that all nets out. In other words, you want to know how much cash you actually have to work with at all times. That’s really important because cash is what keeps your business going. That’s what you’re using to make payroll, buy inventory, pay your rent… cash is basically running your business. What if you closed a ton of sales this week, but you haven’t been paid yet? What if it turns out that you never get paid at all? Cash flow doesn’t measure how much money you’ll have coming in eventually. It measures how much you have at this very moment. That’s exactly what you’ll need to know when it comes time to meet your obligations. So, when you really know your numbers, you also know about your cash.

What Is Your Net Income?

You’ve probably heard companies talk about their “bottom line.” That’s net income, also known as your net profit. That’s what you have left after you’ve paid all of your expenses. You’ll also hear a lot about “Operating Profit,” which is a little bit different because it’s not as comprehensive. Operating profit gives you a great look at how your business is doing, but doesn’t include the cost of your debt, taxes, or that one-time sale of a delivery truck. But net income goes that extra mile and calculates where you stand after everything is all said and done. A lot of good things can come from running a company. You’re creating opportunities for your team. You’re making products that improve people’s lives. And you’re sharing your talents with the world. But none of that continues unless you’re turning a profit over the long term. So, in that sense, you could argue that net income is what it’s all about.

What Is Your Gross Margin?

Your gross profit, as you read about prior, is your revenue minus the direct cost of generating that revenue. But remember, your gross margin expresses that same number as a percentage of revenue. Knowing that percentage is really important for two reasons. The first is that it gives you a sense for how you’re doing year by year. Let’s say your gross profit went up a lot. That’s great. But did your direct costs go up in a proportionate way? Looking at this figure as a percentage gives you a sense for that. The second reason is that it allows you to compare yourself to the major players in your industry. You’ll usually have a sense for typical benchmarks in your field. Are you in line with those or do you need to make some tweaks? Know your numbers and you’ll always be able to answer that question.

What Are Your Total Costs?

Do you remember reading the term “direct costs” earlier? That refers to costs that go directly towards producing your goods or providing your services. Those include things like direct labor, direct materials, and manufacturing equipment. But then you also have what’s known as indirect costs. These might include rent, utilities, and printer ink. Do you have interest due on a small business loan? Did you need to pay an accountant to file your taxes?

Total costs account for every single cost across the board. Because it’s like Marcus always says, “We have to know how much money we have, what we’re spending it on, and keep track of it all at times.” It’s really important to know your numbers and get a clear sense for your total costs, as those will inform your pricing.

Has Your Business Built Equity Yet?

There are a few different ways to value a company. But one of the main ways is to take your assets and subtract your liabilities. Your assets include things like cash, accounts receivable, equipment, and inventory. You can think of assets as all of “the good stuff.” Liabilities, on the other hand, are everything that you owe. This includes the money you owe the bank, your suppliers, and your employees. The difference between those two numbers is often called the “owner’s equity.” Is yours a positive number yet? Or are you still working towards that?

What Is Your Customer Acquisition Cost?

A lot of times you’ll see this abbreviated as “CAC,” but as you’d imagine, this is your cost to acquire each new customer. What you’re really trying to do is build context around your sales and marketing expenses. How much are those? And how much money does each new customer relationship generate? Do those numbers pass a common sense analysis?

If it costs you a ton of money to acquire each customer, but that relationship doesn’t turn into even more money, are there a few things you can tighten up? Know your numbers and whether your marketing juice is worth the squeeze.

What Is Your Customer Retention Rate?

You might see this abbreviated as “CRR,” and again, this metric is appropriately named. It’s just a way of calculating how many customers you’re retaining. If you’re not generating a lot of repeat business, ask yourself if you’re adding enough value. How’s your customer service? Are your competitors doing something to lure people away? As long as you know your numbers and keep a close eye on your customer retention rate, you’ll have plenty of time to get right back on track.

What Is Your Lead to Client Conversion Rate?

Do you know what percentage of your leads actually turn into clients? That’s your conversion rate, and when you know your numbers, you can learn a lot from this. For example, let’s say you sell software and do 1,000 demos. But only two of the people who sat through those demos actually buy what you’re selling. In general, that would probably be considered a fairly low conversion rate, so ask yourself if your price is too high. Was your pitch confusing? Could you do a better job differentiating your software?

However, it’s also important to know the average conversion rate in your industry. For some companies, gaining one new client a year may be the norm while others may need to bring in hundreds of new customers to remain profitable. Whatever the case for your business, it’s essential that you know your numbers, track your conversion rate, and always find plenty of ways to close those deals.

Conclusion

You probably started a business because you had a great feeling about the product or service you are offering. But once you get going, that gut feeling isn’t enough. Take that extra step and really know your numbers. Try to quantify everything and take a fearless look at where you stand. If you don’t like what you see, that’s okay. It’s nothing to worry about. It’s just an invitation to improve, and what’s more, your numbers tell you exactly where you can get better. That way, the next time you look at your numbers, you’re sure to like what you see.

This article is informational only and subject to errors or omissions. As with any legal or regulatory advice, please consult your legal counsel or tax advisor to make sure you are in compliance with all and any federal, state, city or county rules and regulations. More

- Do you know your numbers?

- How can you do a better job of understanding your numbers?

Hayes, A. (2020, August 22). Gross profit. Retrieved from https://www.investopedia.com/terms/g/grossprofit.asp