If you’re sitting on a pile of cash in your business, congratulations! It’s great to have a cushion on hand to cover a slowdown in your monthly cash flow and it’s highly recommended to always keep a certain amount of money on hand for emergencies. But rather than collect a few pennies in interest each month, you could turn that extra cash into income-producing assets. This strategy can create new revenue streams or open the door to greater market opportunities. As Marcus Lemonis says, “You’ll have skin in the game.”

Before investing your cash, though, take a close look at your business’ overall financial position. Think about how much you need to keep in reserve for unexpected operating expenses. Also look at your current loans, mortgages or other liabilities. If your bank loan has a 5 percent interest rate, then an additional payment would, in effect, be generating a 5 percent return. So any income-producing assets you would acquire should deliver a higher potential return.

Otherwise, you would be better advised to pay down the loan. And if you have a business credit card with a double-digit interest rate, you should use cash to pay off that balance each month!

Nevertheless, there are many ways to boost your business’ revenue stream and profitability by acquiring income-producing assets. For instance, when a family-owned candy business launched their store in North Florida, the company found a “sweet spot” in the local market, but ran into financial difficulties and called on Marcus for help. Under Marcus’s guidance, the shop improved its candy-making kitchen operations, and moved to a prominent high-traffic location, leading to a significant increase in revenue. This allowed the business to build up its cash reserves and purchase an adjacent building to expand its production capabilities.

What are Some Income-Producing Assets?

Your business is one example of an income-producing asset. If it didn’t provide you with revenue, you would probably have to close the door and look for a job. However, there are a few types of businesses, such as pharmaceutical or medical research companies, that can succeed in the future, even if they are not producing income right now.

In any case, your business requires an active commitment of your time and energy, so you may want to look for income-producing assets that require a lower level of involvement.

Here are several examples:

- Rental real estate. Commercial and residential properties are available at a wide range of prices in virtually every market.

- Investing in other businesses. This might involve acquiring another company or taking a minority share and letting someone else handle the operations.

- Savings accounts, money market accounts and certificates of deposit. These offer the advantages of immediate liquidity, but typically have low rates of return.

- Peer-to-peer lending. Basically, you provide a business loan to a borrower.

One of the most famous income-oriented investors is Warren Buffett, chairman and CEO of Berkshire Hathaway. Known for his long-term approach to stocks, bonds and other assets, Buffet reported more than $3.8 billion in dividends in a 2019 annual letter to shareholders.

Turning Cash Into Income-Producing Assets

There are many strategies for turning your extra cash into income-producing assets, including the following.

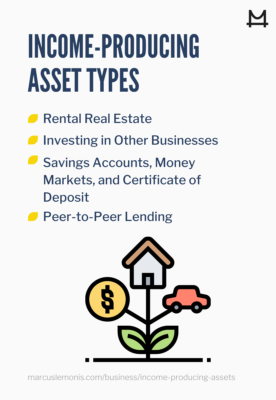

- Buy real estate. Real estate can be an important addition to your portfolio of business assets. Purchasing a commercial property and leasing it out can generate a steady flow of income, while increasing the book value of your business. Other benefits of owning real estate include potential appreciation and tax advantages such as depreciation.

Another great thing about real estate is that you could use a mortgage loan as leverage, multiplying the impact of your cash investment. However, those loan payments would need to be subtracted from the monthly rent payments. Be sure to compare the projected rates of return with and without a loan to see which works best for your business.

There are other ways to benefit from buying commercial real estate. For instance, if you are considering an expansion, you could acquire a suitable property in the target market. You could lease that property to produce income until it’s time to make the move. If your business is leasing space now, you should consider purchasing the property. You would no longer have to pay rent to a landlord, improving your monthly cash flow. Ownership also offers the potential for appreciation.

If your business has extra space available, you could generate extra income and increase your cash reserves by finding a suitable tenant. For instance, if you have a vacant suite in your office, you could turn those wasted square feet into an income-producing asset. But don’t lease that space to a competitor or a business that would interfere with your operations!

- Make an acquisition. One of the time-tested ways to grow your business is to acquire a competitor. This is another great strategy for using your cash to generate income-producing assets. If all goes well with the acquisition, your business will gain access to your competitor’s customers, creating a robust new stream of revenue. But you don’t have to limit your acquisition targets only to your competitors. Look for opportunities to use your cash to buy a business with related products or services. This strategy can allow you to enter a new market more rapidly and efficiently than starting from scratch. And if you play your cards right, you can also capitalize on cross-selling and upselling opportunities.

- Offer peer-to-peer lending. Do you know another business in your market that could benefit from extra cash? If so, you could create a new revenue stream through peer-to-peer lending. This strategy can create a new income-producing asset for your business with a significant upfront investment.

You don’t have to lay out cash to buy real estate or another business – you simply make a loan at a competitive interest rate and enjoy the incoming flow of dollars. With peer-to-peer lending, you need to conduct a due diligence analysis to make sure the borrower has the financial ability to make those payments on your loan. You may also want to secure the loan with a lien on the business’ assets, as insurance in case the borrower defaults before the final payment. If you want to pursue this strategy, be sure to have a business lawyer draw up the documents needed for a mutually beneficial agreement.

A Step-By-Step Approach

If you are considering ways to put your cash into income-producing assets, this step-by-step approach can help you make a good decision. As Marcus says, “You have to know your numbers.”

1. Determine your current cash on hand. This typically includes funds in a business checking, savings or money market account, as well as any petty cash in your establishment.

2. Increase your available cash. If you are thinking about buying a property or making an acquisition, you might want to look for ways to redeploy your current assets. For instance, if you have a large fleet of service vehicles, you could sell several trucks to raise cash. If you have a satellite facility that is losing money, look for a potential buyer or shut it down, reducing your outgoing expenditures.

On a national level, Wells Fargo sold dozens of its bank branches in 2020 to reduce annual expenses, and improve its financial position. In the small business sector, Marcus helped the owner of a northeastern-based lighting company understand how the money that was tied up in his extensive inventory was severely affecting the company. By selling off the excess products, the owner was able to increase the business’ cash reserves and redeploy the money for other purposes. The result was a stronger company that the owner was later able to sell to a much larger business for a profit.

3. Analyze both the risks and potential returns. Some types of income-producing assets can generate greater returns than others. Of course, they often carry higher risks as well. If your main goal is a steady and secure stream of income, you may not want to acquire another company or offer peer-to-peer loans.

4. Consider your own resources. If you have a stable business with good managers in place, you may be able to devote more of your time and attention to a new income-producing asset. But if you are focusing your energy on your current business, then you should look for a more passive investment – an asset that provides income without requiring your personal resources.

Make a smart decision

It takes knowledge of your options and the willingness to do your homework in order to make a smart decision about turning your cash into income-producing assets. If all signals are “go,” then you can move forward with confidence to add a new stream of revenue to your current operations. As Marcus says, “In any business, you can’t be complacent. If you do, you’re going to go backwards.”

- What assets do you currently have?

- Which types of income-producing assets are right for your business?

Ashworth, W. (2020, March 3). 10 key lessons Warren Buffett shares in his annual shareholder letter. Retrieved from https://investorplace.com/2020/03/10-key-lessons-warren-buffett-shares-in-his-annual-shareholder-letter/

Dixon, A. (2018, November 30). What to expect when your bank sells your checking account. Retrieved from https://www.bankrate.com/banking/flagstar-wells-fargo-acquisition-what-to-know/