There is more to owning a home than simply paying the mortgage, taxes, and utilities. The cost of maintaining your home is one thing that a lot of first-time home buyers just don’t think about— until something breaks, of course, and then they get stuck with a hefty repair bill.

All the routine checks and tune-ups that you neglect to do on a regular basis are called “deferred maintenance,” and it can really come back to haunt you, taking a toll on your wallet and the value of your home.

Calculate Maintenance Costs Before You Buy

I think a lot of times people go into their budgeting process and forget to calculate what it takes to maintain the house.

When I was younger, I was guilty of this, too. I really didn’t consider the consequences of my home financial decisions—it was all about the instant gratification. I needed to feel like I had arrived. Buying my first home, the satisfaction that I got when somebody handed me the keys— the euphoria you feel—I don’t think there’s anything better.

When I meet young people today, I tell them, “Stop buying stupid things! Save money and buy your first home because you will never look at the world the same way when you own your first home. And it doesn’t matter how big it is or where it is. It doesn’t matter how fancy it is or how small it is. When it’s yours, boy, it feels special.”

That’s why I get angry when people don’t take care of their home.

Protect Your Investment

We had a homeowner on The Renovator that just didn’t do the upkeep. They had nice cars, they had nice handbags, they had nice clothes, and I’m not judging them, but their yard was gross. And their wood frame doors were rotting, and they hadn’t painted things, and there was tile missing.

I loved that family, but I didn’t love their decision-making. Do you remember how much work you had to do and how much anxiety you experienced to get approved by the bank? Then, you let your yard, or your house, look like this? It’s like, what are you doing?

Add Maintenance to Your Budget

Maintenance is a line item on your monthly budget that you must consider.

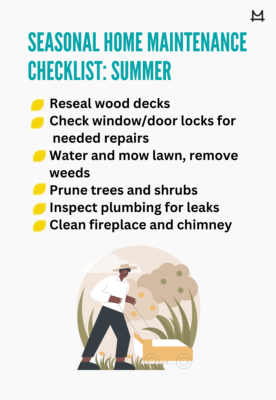

If you’re going to have an asset, especially an appreciating asset like your home, it needs love and care. If you leave that part out, if you let it go, you don’t clean stuff, tiles are broken, yards are unkempt, fences are damaged, there’s no gutters, and you’re not painting your house, the value is going to be lessened.

But, if you preserve it, take care of it and keep it clean, the value is going to go up.

Maintain Your Home For Your Family

My original goal with The Renovator was to help people understand how to build wealth and how to build value.

For most people, buying a home is the single biggest asset that will move from one generation to the next generation. If you’re going to pass on something like a home, the way that you keep it up will create the value that you’ll pass on.

I really want families to understand that the work we are doing today is going to add value not just to their life, but to their kids’ and their grandkids’ lives.

Leave No Fixture Untouched

Maintenance isn’t just cutting the grass and painting the interior and exterior. It’s maintaining every single thing. If you put in wood floors, that means washing them with the right materials. And you’ve got to be able to do that research to understand that you don’t put regular floor soap on wood floors—it’ll eat it away! So, you’ve got to be thoughtful about things like that.

Maintenance and deferred maintenance and all these words that we use are just another way of saying to take care of your things.

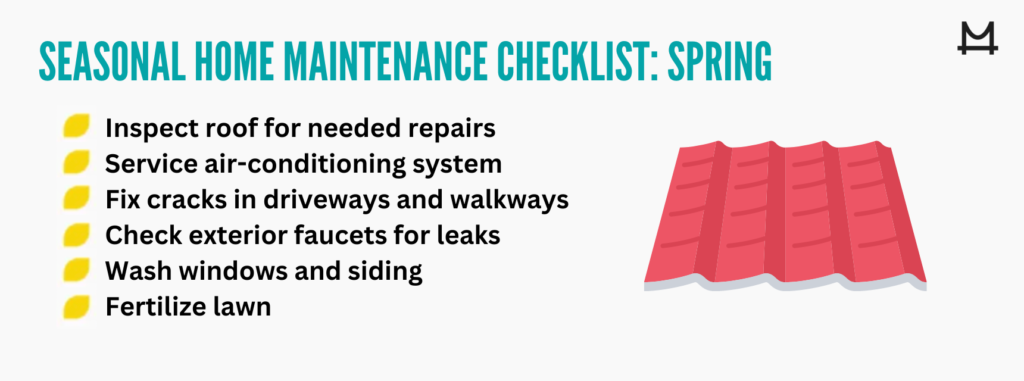

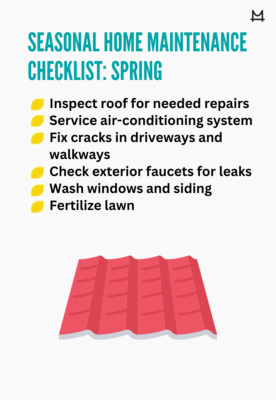

This requires more than simply what you see. Have somebody check out your air-conditioning units on an annual basis, have a plumber come out once a year and make sure that all your pipes are clean. It’s okay to budget a little bit to have somebody look at the things you don’t see, because when that air conditioning breaks, because it wasn’t maintained, that’s not going to be $100 or $200, it’s going to be $2,000.

Get Real With Your Monthly Budget

There is no kind of formulaic amount that you should put aside. Every home is different. You should do the analysis at your actual home and determine for yourself: between my mortgage payment, my taxes, my utilities, and all my other expenses—plus, the maintenance this house requires to keep it up—can I afford it?

Stay on Track Any Way You Can

In my house, I’ve got three different vents where I have to change out the air filter, and there’s a nice little place on the air filter where I can put the date when it was changed. Even so, I have to remember to go and open that vent to see what the date was. It’s not something where I just walk by the vent and go, “Oh, you know what, that air filter needs changing?” So how do I keep up with it? I’m busy, I’ve got a lot going on.

Nowadays, there are apps to help you keep track (Househappy, HomeZada, and others) You could also buy a good old-fashioned calendar and put a little note on there of what you’re supposed to do and when.